How to Optimize P&C Insurance Companies for Growth & Success

Software for insurance companies is rapidly changing the way client needs are addressed. Insurtech innovations can be found in every nook and cranny...

Elevating the customer journey through digital transformation.

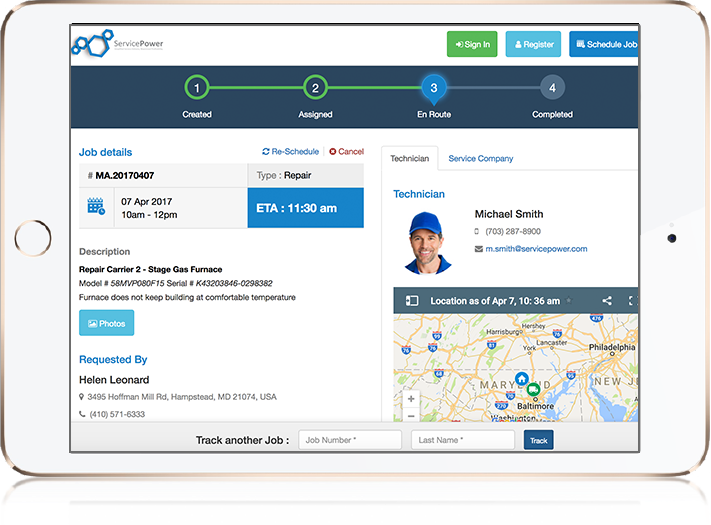

The insurance industry is experiencing intense public scrutiny and demands from customers for better service. Consumer expectations are high, with today’s post-Millennials accustomed to a variety of self-help tools, online portals, phone apps, chatbots, and real-time tracking of interactions. To meet evolving demands, many insurance providers will need to update systems.

Scrapping entrenched legacy processes and adopting modern digital capabilities will help launch a new era in customer engagement. Field service management solutions provide a wide range of customer-centric capabilities--valuable tools for improving the customer experience.

Reluctance and caution

Insurance companies tend to be highly risk adverse. This means they are often slow adopters of new technology, avoiding proof-of-concept-type projects and insisting on mature solutions with functionality that’s been rigorously stress-tested. After all, insurers need to provide reliable response, even during cataclysmic events. This means zero tolerance for unexpected downtime. Security breaches, hurdles with data integrity, or glitches with file access are also unacceptable.

Legacy systems also contain a huge volume of documents in storage. The task of scanning and digitizing all of that data can seem daunting. It’s no wonder insurers have often taken a cautious approach to revamping technology.

Times have changed

The benefits of modern solutions now outweigh the risks or hassles of change. Digitalization means business processes are connected, data-driven, accessible, and visible in real-time. Business silos are eliminated along with disparate systems that can diminish data integrity. Information is visible and shared in real-time so there is one version of the business truth that is trusted and leveraged for daily operations as well as long-term strategies. Digitalization heralds a new era in data-driven efficiency and connectivity.

Insurance providers are recognizing the value. A recent Accenture survey revealed top priorities for insurance providers:

Digitalization: 72%

Platform modernization: 64%

Data integrity and analytics: 64%

A related report says, “The insurance industry is at a pivotal moment as it grapples with technological transformation, regulatory pressures, and the promise of artificial intelligence.” A survey reveals both ambitious plans for innovation and concerning gaps in implementation. “As macroeconomic challenges — including inflation, climate change and cybersecurity risks — continue to impact the industry, the pressure to modernize operations has never been greater.”

Updates are not always going as planned. In 2022, the need for modernization was called a top priority for insurers looking to move beyond legacy technology. “Yet in 2024, nearly half (49%) of insurance companies admit to being behind schedule on their modernization plans.”

Not knowing where to begin or how to get started can be part of the problem. Taking time to formulate a strategy, before leaping into any action plan, is smart. Your strategic plan should help you set goals, define how you will measure success, and identify critical stakeholders who need to be involved in exploring software options.

Focus on Field Management

One way to ease the transition to digitalization is to focus on specific use cases first, such as field service. Field service management solutions cover a wide range of customer interactions, from fielding phone calls to dispatching agents. Field service management solutions can play a valuable role in managing the entire claims lifecycle, assigning agents, dispatching adjusters, gathering data on estimates, and issuing payments.

The scheduling component is particularly important. Scheduling and dispatching inspectors or claims adjusters is very tedious, time consuming, and stressful when performed manually. Many factors are involved in planning an effective schedule, from estimating the drive-time between locations to allowing the appropriate time for the on-site inspection. With the right software in place, the process can be transformed into one that is fast, easy, and effective. Smart scheduling will allow the adjuster to fit in more inspections per day. Accurate arrival windows can be issued to customers, so they experience the least stress and inconvenience as possible.

Customers can also opt to communicate and set up inspections through online portals, the preferred method of communication for many market segments. Remote collaboration with real-time updates helps foster positive relationships with customers. They get the attentive service they want, with convenience and flexibility. Customers can cancel or change times if needed.

Twelve benefits of smart field service solutions for insurance providers:

The wrap up

These benefits are only the beginning. Consider digitalization and the use of field service management solutions to be a journey. While some insurers are at early planning stages, others may be ready to take on advanced applications. Modern solutions can help you achieve your goals, whether it is the basics of schedule optimization or using AI-powered analytics to monitor for fraud.

Also, as the expectations of customers evolve, the applications of technology can evolve, too. Insurance providers can continue to expand and enhance abilities, using software to automate and provide valuable insights. The important first step toward modernizing is to become well-versed in the options and the solutions available. ServicePower provides an end-to-end service management solution with advanced schedule optimization and automated claims reimbursement like no other solution. Download our whitepaper to learn more about it.

Software for insurance companies is rapidly changing the way client needs are addressed. Insurtech innovations can be found in every nook and cranny...

As a field service leader looking to embrace digital transformation and leverage Data-Driven Decision Making, investing in the right software is...

When your business model, backed by your current stack of enterprise workforce management software, has been working well, it's hard to see a reason...